About

Ching-Chuan (David) Wang is a Ph.D. Candidate in Accounting at the University of Utah. His research focuses on archival financial accounting, with a special emphasis on corporate disclosure and information intermediaries. He examines how firms strategically manage disclosure in response to regulatory changes and competitive pressures, and how these disclosure practices influence capital formation and investor decision-making. He teaches Managerial Accounting and has received the Doctoral Student Teaching Excellence Award at the University of Utah. He is on the academic job market in 2025–2026.

Curriculum Vitae

Email: david.c.wang@eccles.utah.edu

Education

Ph.D. in Accounting, University of Utah, 2026 (expected)

M.S. in Finance, University of British Columbia, 2020

M.A. in Economics, Duke University, 2016

B.S. in Finance, Statistics (minor), National Chengchi University, 2013

Certification

- Certified Management Accountant (CMA)

Working Papers

| [1] Spillover Effect of Government Subsidies on Peer Firm Disclosure (Job Market Paper) |  |

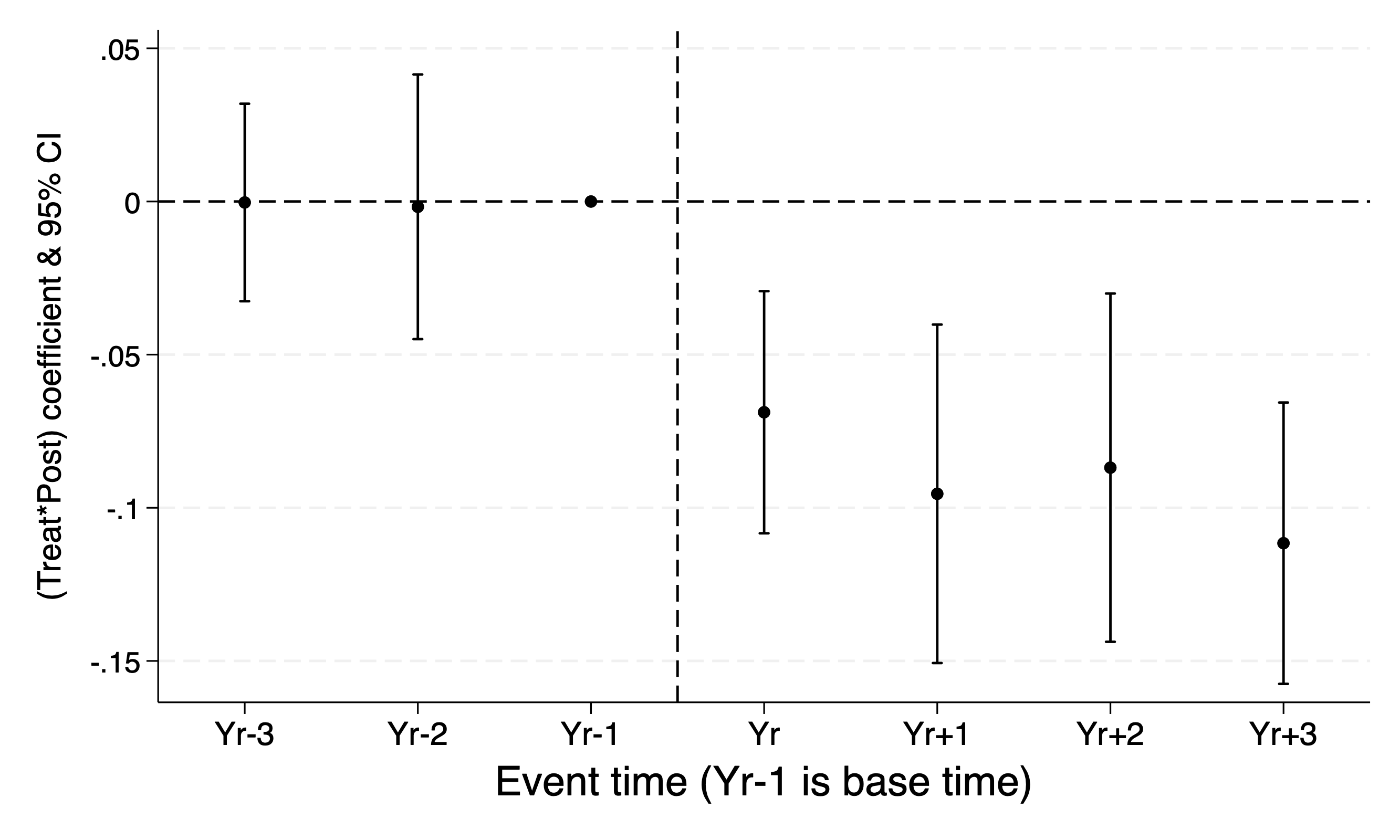

| Abstract: Federal and state governments frequently utilize subsidies to support businesses in the United States. While previous studies have examined how subsidies affect recipient firms, spillover effects on non-recipient peer firms have received limited attention. This research investigates how peer firms respond to government subsidies awarded to their competitors, particularly through changes in corporate disclosures. The findings reveal that peer firms significantly increase disclosures across 10-K filings, 8-K filings, and corporate website content. This transparency enhancement is more pronounced among peer firms with weaker fundamental performance, greater financial constraints, and exposure to heightened competition, suggesting that firms facing greater competitive pressure are more likely to adjust disclosure practices in response to subsidy events. These findings demonstrate how peer firms strategically enhance transparency to navigate challenges posed by subsidized competition, contributing to the understanding of disclosure dynamics and government policy spillover effects. | |

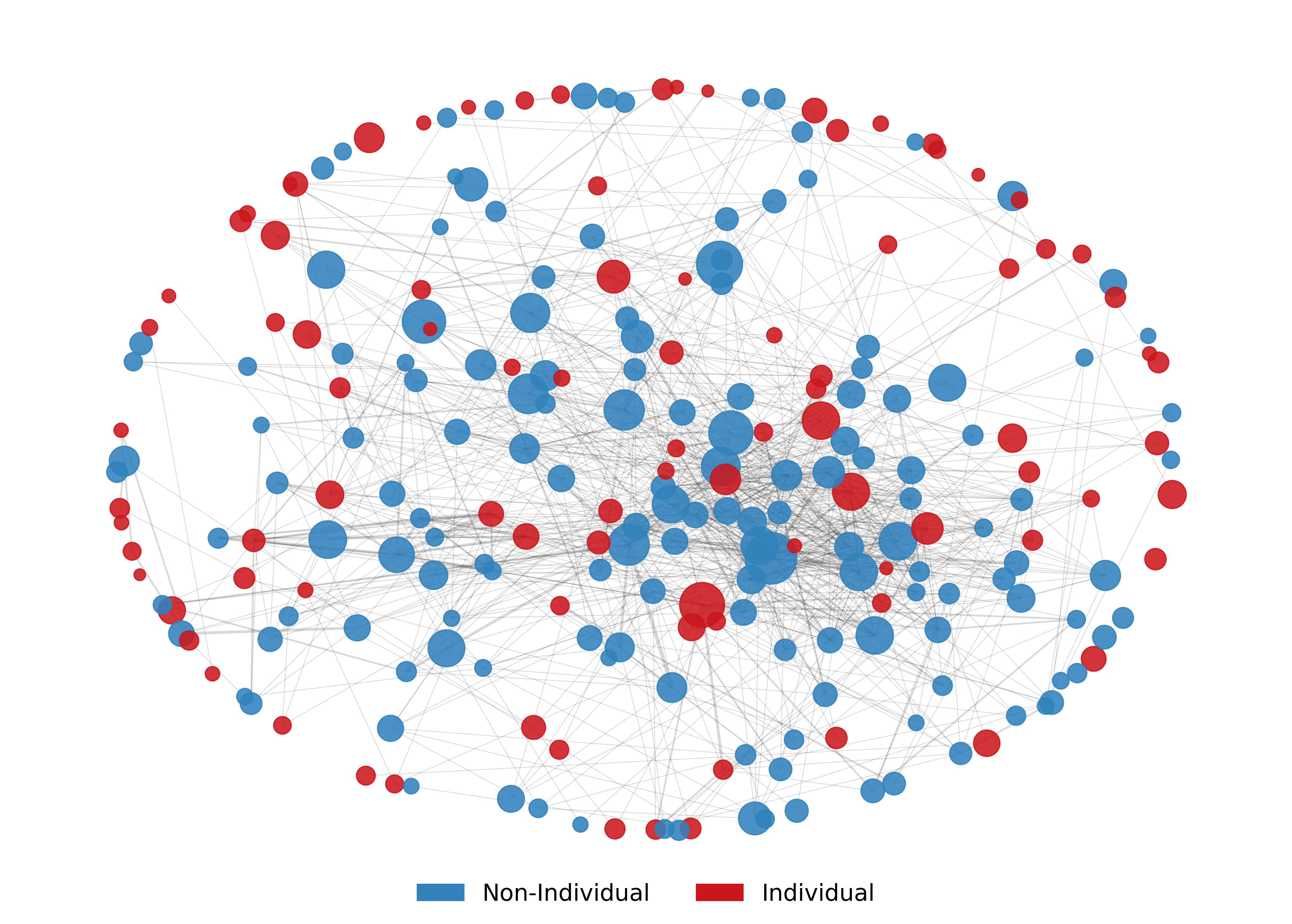

| [2] Signaling in the Twilight Zone: Disclosure and Credibility in the OTC Market [SSRN] |  |

| [3] Does Specialization Lead to Disagreement? |  |

| [4] The Price of Peer Disclosure: OTC Transparency and IPO Pricing |  |

(*: Presented by coauthors)

Teaching

University of Utah

- Management Accounting (ACCT 5210), Undergraduate, Summer 2025

- Average Instructor Rating: 4.9/5.0; Median: 5.0/5.0

- Management Accounting (ACCT 5210), Undergraduate, Summer 2023

- Average Instructor Rating: 5.5/6.0; Median: 6.0/6.0

- Received Doctoral Student Teaching Excellence Award

Misc

- Academic Genealogy: Merton Miller → Eugene Fama → Ross Watts → Richard Sloan → Scott Richardson → Atif Ellahie → Ching-Chuan Wang